Join Our Exclusive Investor Group

Due to rapid growth from increased demand we are seeking 2-3 accredited investors to join our small group of exclusive participants.

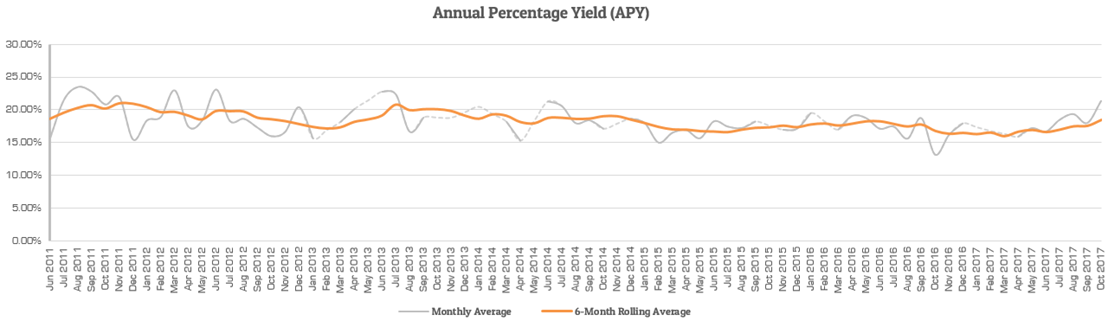

- Consistent Double Digit Returns

- Proprietary Risk Reduction Strategies

- Secured by First-Position Real Estate

- Proven Track Record of Performance

- Passive Investment Requires Little Time

- Insulated From Public Market Fluctuations

What The Experts Say About Hard Money & Alternative Investments

Financing private mortgages can equal strong returns. Typical loans usually last six months… but the payoff is big – Bankrate®

Alternative assets often cushion market volatility present in more traditional investments like those found in the public markets. -Huffington Post®

Alternatives may help investors achieve a smoother investment experience over various market cycles, allowing for long-term outperformance. -Goldman Sachs®

DHM is in no way guaranteeing or promising any return whatsoever. The above numbers are given as a convenience. Actual terms are dependent upon the borrower and the actual loan provided. Past performance does not determine or dictate future performance.? Any capital used by investors should be risk capital.

This is not an offer to purchase or sell securities. Per Utah Division of Securities belief that under the Reeves test (494 U.S. 56 (1990) this would not be an offer to sell securities per Memo Dated October 7, 2008. That being said, every investor must carefully look at their financial situation and only invest funds that they are financially able to lose.? Ryan Wright, DoHardMoney.com Inc.: do hereby declare that we are NOT a Licensed United States Securities Dealer, Broker, or U.S. Investment Advisor. We further do hereby declare that we are NOT a Private Investor and Advisor. ?These documents are never to be considered a solicitation for any purpose in any form or content. ?Upon receipt of these documents you, as the Recipient, hereby acknowledges this warning and disclaimer. ?If acknowledgment is not accepted, Recipients must return the document copies, in their original receipted condition, to Sender via postal services immediately. Address: 8785 S Jordan Valley Way, West Jordan, UT 84088

Any Samples given are simply Samples. Samples do not represent or make any guarantees. They are provided for educational and conceptual purposes only and may or may not reflect the outcome of any loans. Any capital used in doing loans should be considered risk capital. By continuing to read this material I agree that I am an Accredited Investor as defined by The Internal Revenue Services.

**ACCREDITED INVESTOR QUALIFICATION

By submitting the form above applicant?represents and certifies that they are an?Accredited Investor based on the following initialed criteria set forth by the Securities Act of 1933, Rule 501 of Regulation D… at least one of the following must apply:

- Applicant is a bank, insurance company, registered investment company, business development company, or small business investment company;

- ?Applicant is an employee benefit plan, within the meaning of the Employee Retirement Income Security Act, if a bank insurance company, or registered investment advisor makes the investment decisions, or if the plan has total assets in excess of $5 million;

- Applicant is a charitable organization, corporation, or partnership with assets exceeding $5 million;

- Applicant is a director, executive officer, or general partner of the company selling the securities;

- ?Applicant is a business in which all the equity owners are accredited investors;

- Applicant is a natural person who has individual net worth, or joint net worth with the persons spouse, that exceeds $1 million at the time of the purchase (Excluding Primary Residence);

- ?Applicant is a natural person with income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year;

- Applicant is a trust with assets in excess of $5 million, not formed to acquired the securities offered, whose purchases a sophisticated person makes.